Banking and Financial Institutions

NBB announces AGM on March 11; book closure on February 18

February 5:

Nepal Bangladesh Bank Limited has announced its Annual General Meeting on March 11 to formally endorse 17.89 percent dividend, including 10 percent bonus shares to its shareholders from the net profit the bank posted in the last fiscal year 2069/70.

Nepal Bangladesh Bank Limited has announced its Annual General Meeting on March 11 to formally endorse 17.89 percent dividend, including 10 percent bonus shares to its shareholders from the net profit the bank posted in the last fiscal year 2069/70.

The commercial bank has also announced the book closure on February 18 for the AGM. Hence, only those shareholders would be eligible for the proposed dividend who hold the shares of the bank up to February 17.

Pleasantly surprising its shareholders, the Board of Directors of NBB pledged 17.79 percent dividends from the net profit it posted in the last fiscal year.

NBB had posted a net profit of Rs.59.07 crore in the last fiscal year.

Machhapuchchhre Bank reports astounding profit rise of 520 % in Q2

February 5:

Machhapuchchhre Bank Limited has reported a massive rise in profit in the second quarter of the current fiscal year 2070/71.

Publishing the unaudited quarterly report for the second quarter today, the commercial bank has stated that it has posted a profit rise of 520 percent in the second quarter as its net profit rose to Rs 20.40 crore, up from merely Rs 3.29 crore in the corresponding quarter last fiscal year.

Machhapuchchhre has managed to post the impressive growth despite provisioning Rs 6.47 crore for possible losses.

Machhapuchchhre’s net interest income has surged to Rs 48.99 crore, up from Rs 37.31 crore in the second quarter of the last fiscal year.

Similarly, the bank also mobilized Rs 31.11 arba in deposit and Rs 25.27 arba in loan as compared to Rs 22.55 arba in deposit and Rs 18.61 arba in loan in the corresponding quarter of the last fiscal.

The bank also recovered Rs 4.43 crore as the write back of the amount provisioned for possible losses.

The bank’s non-performing loan has also decreased from 3.07 percent in the second quarter of the last fiscal year to 2.67 percent.

Its EPS has surged to Rs 16.46 from just Rs 1.33 in the corresponding quarter, and its net worth per share has also risen to Rs 125.74, up from Rs 108.16.

एनसीसी बोर्ड राष्ट्र बैंकबाट ‘टेकओभर’, तीन सदस्यीय टोली पठायो, छ महिना भित्र नयाँ सञ्चालक समिति

काठमाडौं । नेपाल राष्ट्र बैंकले एनसीसी बैंकको सञ्चालक समिति ‘टेकओभर’ गरेको छ । राष्ट्र बैंकको मंगलबार विहान बसेको बोर्ड बैठकले एनसीसीको तत्कालिन सञ्चालक समिति निलम्बन गरी राष्ट्र बैंकका प्रतिनिधिमार्फत बैंक सञ्चालन गर्ने निर्णय गरेको हो । एनसीसी बैंकको सञ्चालक समितिमा रहेका दुई पक्षबीच तिब्र विवाद देखिएपछि निलम्बन गर्ने निर्णय गरेको राष्ट्र बैंक स्रोतले जनाएको छ । सञ्चालक समितिमा रहेको दुई पक्षलाई मिल्न बारम्बार निर्देशन दिदाँ पनि विवाद कायम रहेपछि राष्ट्र बैंकले हस्तक्षेप गरेको हो । बैंकको व्यवस्थापन भने अहिलेकै व्यक्तिहरुबाट सञ्चालन हुनेछ ।

राष्ट्र बैंकले निर्देशक लक्ष्मी प्रपन्न निरौलाको संयोजकत्वमा तीन सदस्यी टोली एनसीसीमा पठाउने निर्णय गरेको हो । निर्देशक निरौलाको टोलीमा उपनिर्देशक रमेश आचार्य र सहायक निर्देशक रेशम राज रेग्मी रहेका छन् । राष्ट्र बैंकको टोलीले बुधबारबाटै जिम्मेवारी सम्हाल्ने छ । यो टोलीलाई छ महिनाभित्र नयाँ सञ्चालक समितिको निर्वाचन गराउने र २०७१ असार मसान्त भित्र तोकिएको (दुई अर्ब) चुक्तापुजी पुर्याउने अख्तियारी दिइएको छ । चुक्ता पुजी पुर्याउन हालका सेयरधनीले थप लगानी नगरे मर्ज गर्ने वा अन्य विकल्प खोज्ने अख्तियारी पनि राष्ट्र बैंकको टोलीलाई दिइएको छ । यो टोलीले बैकको डिडिए पनि गराउने छ । त्यस्तै सञ्चालक नियुक्त गर्न सक्ने लगानी कर्ता वा एक प्रतिसत भन्दा बढी सेयर लिने सस्थापकहरुले कर्जा लिएको भए उनीहरुबाट कर्जा असुली गर्न पनि अख्तियारी दिइएको छ । यस्तो कर्जा असुली गर्न सेयरधनीको नाममा रहेको सेयर बिक्री गर्न सक्ने सम्मको अधिकार राष्ट्र बैंकको टोलीलार्इ दिइएको छ । सञ्चालक समितिमा प्रतिनिधित्व गर्ने एनबी समूह पक्ष र निर्मल प्रधान पक्षबीच तीब्र विवाद भएपछि गत कात्तिक १६ गते पछि सञ्चालक समितिको बैठक बसेको छैन । लामो समयसम्म सञ्चालक समितिको बैठक नै बस्न नसक्दा बैंकका आगामी योजनामा समेत असर पर्न थालेको देखिएपछि राष्ट बैंकले निलम्बन गर्ने निर्णय गरेको हो । मंसिर दोस्रो साता नै १५ दिन भित्र विवाद मिलाउन राष्ट्र बैंकले निर्देशन दिएको थियो । विवाद नमिले हस्तक्षेप गर्ने चेतावनी त्यही बेला राष्ट्र बैंकले दिएको थियो । एनबी समूहको पक्षमा अध्यक्ष पृथ्वीराज लिगल सहित सञ्चालकहरु बेदमान सिंह मल्ल, बद्रिनारायण मानन्धर, नारायणराज तिवारी, वासुदेव गिरी, ज्ञानहरी श्रेष्ठ छन् । निर्मल प्रधान समूहमा तीर्थ प्रधान, डा. अशोक शम्शेर जबरा र हरिप्रसाद भट्टराई छन् । प्रधानसमूहले पुनरावेदन अदालतमा विशेष साधारण सभाका लागि निवेदन दिएको थियो । अदालतले विशेष साधारण सभा बोलाउन निर्देशन दिएको भएपनि सञ्चालक समितिले निर्णय गरेको थिएन । विवाद यस्तो थियो प्रधान समूहले डिएनएस इन्भेष्टमेन्ट प्रालिलाई दिएको सात करोड ऋणमा भ्रष्टाचार गरेको, एनबी समूहका विभिन्न व्यक्ति तथा फर्मका नाममा रहेको १० लाख आठ हजार पाँच सय ४६ कित्ता सेयर बैंकले कर्जा असुली वापत लिनु पर्नेमा अनधिकृत रुपमा विक्री गरी वर्तमान बजार मूल्य अनुसार ४० करोड भ्रष्टाचार गरेको र एनबी समूहको इन्टरनेशनल क्लबलाई कर्जा दिदा भ्रष्टचार गरेको आरोप लगाएको छ । प्रधान समूहले गत असार मै बैंकमा भ्रष्टाचार भएको भन्दै राष्ट्र बैंकमा निवेदन बुझाएको थियो । तत्काल साधारण सभा गर्न दवाव दिदै आएको प्रधान समूहले कम्पनी रजिष्ट्रारको कार्यालयमा पनि साधारण सभाका लागि निवेदन दिएको छ । एनवी इन्सयोरेन्सलाई प्रिमियम वापत ४० करोड रुपैयाँ गैरकानुनी रुपमा वियरर चेक बनाएर भुक्तानी दिएको आरोप पनि लगाएको छ । प्रधान समूहले अध्यक्ष सहित छ जना विरुद्ध अविश्वास प्रस्ताव दर्ता पनि गराएको थियो भने एनवी समूहले राष्ट्र बैंकमा राजीनामा बुझाएको थियो । बैंक सञ्चालक समितिमा छलफल नै नगरी १५ प्रतिसत लाभांस दिने घोषणा गरेको भन्दै प्रधान समूहले धितोपत्र बोर्डमा पनि निवेदन दिएको थियो । प्रधान समूह आक्रामक थियो भने एनवी समूह रक्षात्मक देखिएको थियो ।

कुमार लम्सालले किस्टमा प्रमुख कार्यकारीको कार्यभार सम्हाले, अशोक शेरचन बने नायव सिईओ

कुमार लम्सालले किष्ट बैंकको प्रमुख कार्यकारी अधिकृत र अशोक शेरचनले नायव सिईओरुपमा आइतबार देखि कार्यभार सम्हालेका छन् । किस्टमा जाने पक्का भएपछि लम्सालले गत महिना सानिमा बैंकको प्रमुख कार्यकारीबाट र शेरचनले प्रभु विकास बैंकको प्रमुख कार्यकारीबाट राजीनामा गरेका थिए । व्यवस्थापनको उच्च पदमा नियुक्त यी दुबै बैंकरले आइतबार देखि विधिवत रुपमा पदभार सम्हालेका हुन् । जम्को प्रकाशन प्रालिलाई कर्जा दिँदा गरेको घोटाला छानविन गर्दा दोषी देखिए पछि आठ महिना अघि किष्टका तात्कालिन प्रबन्ध सञ्चालक कमल ज्ञवाली फरार भएका थिए । त्यस पछि कायम मुकायम जिम्मेवारी पाएका विएन घर्तीलाई समेत सोहि प्रकरणमा नेपाल प्रहरीको केन्द्रिय अनुसन्धान व्युरोले पक्राउ गरे पछि सञ्चालक समितिले भेषराज खतिवडालाई निमित्त दिएको थियो । सानिमा स्थापनाताका महाप्रबन्धक रहेका लम्साल चार बर्ष देखि प्रमुख कार्यकारीको जिम्मेवारीमा थिए । उनले सानिमालाई विकास बैंकबाट बाणिज्य बैंकमा स्तरोन्नती गर्ने क्रममा कुशल नेतृत्व दिएका थिए । जम्को प्रकाशन लगायतलाई दिएको कर्जा नउठे पछि घाटा व्यहोरिरहेको किष्टलाई नाफामा लैजाने तथा संस्थागत सुशासन कायम गर्ने जिम्मेवारी उनीहरुको काँधमा आएको छ । जिम्मेवारी सम्हाले पछि बिजमाण्डूसँग कुरा गर्दै प्रमुख कार्यकारी अधिकृत लम्सालले आफ्नो पहिलो प्राथमिकता खराव कर्जा असुलीमा हुने बताए । ‘धेरैजसो खराव कर्जाको नोक्सानी व्यवस्था भइसकेको छ, उनले भने, कर्जा असुलीलाई प्राथमिकता दिएर आगामी चैतमसान्तसम्मको व्यालेन्सिटमा सुधार ल्याउँछौं ।’

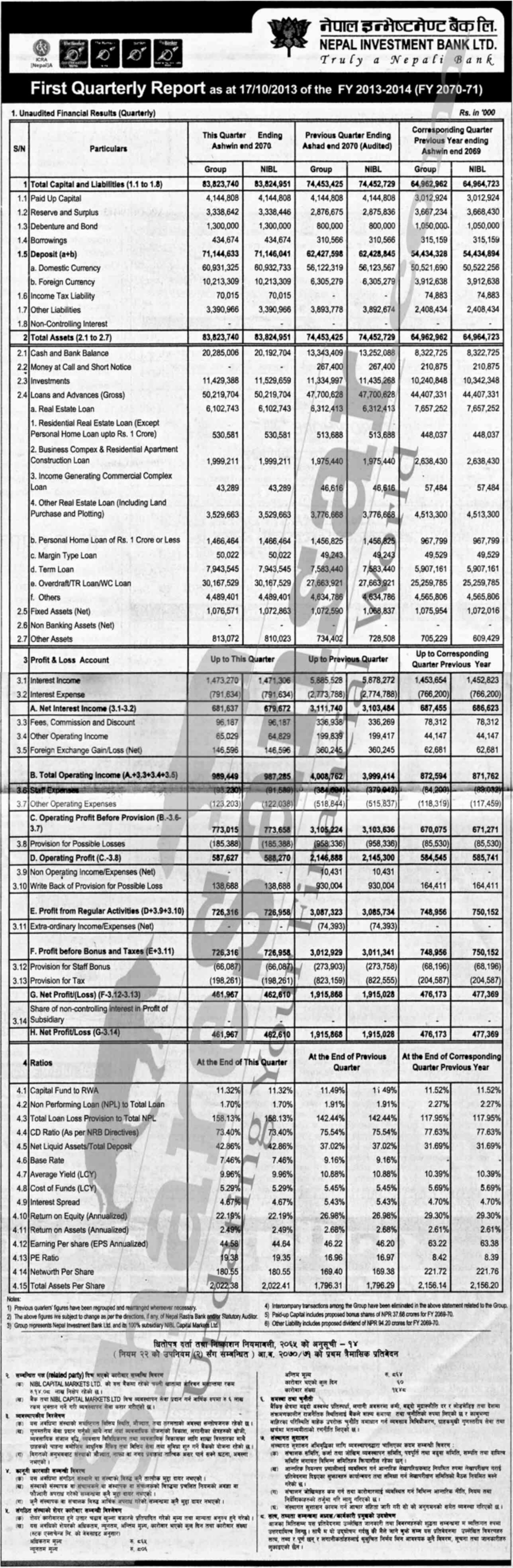

NIBL reports 5.3 % profit rise in second quarter; its NPL drops from 3.17 to 1.76

NIBL reports 5.3 % profit rise in second quarter; its NPL drops from 3.17 to 1.76

Nepal Investment Bank Limited has reported a marginal rise in profit in the second quarter of the current fiscal year 2070/71.

Publishing the unaudited quarterly report for the second quarter today, the commercial bank with one of the largest client bases, has stated that it has posted a profit rise of 5.34 percent in the second quarter as its net profit rose to Rs 93.88 crore, up from Rs 89.12 crore in the corresponding quarter last fiscal year.

The profit of the bank was basically caused by its profit from regular activities as it has risen from 1.40 arba to 1.47 arba.

NIBL also mobilized Rs 71.99 arba in deposit and 52.25 arba in loan in the second quarter up from Rs 55.13 arba in deposit and Rs 46.44 arba in loan in the corresponding quarter last fiscal.

NIBL has also reported Rs 21.27 crore as a write back of provision for possible loss in the second quarter.

Its net interest income, however, has dropped marginally from Rs 1.45 arba to Rs 1.41 arba owing to larger interest expense.

On the other hand, its non-performing loan has dropped from 3.17 percent to 1.76 percent in the second quarter.

It’s EPS (annualized) stands at Rs 45.28 and net worth per share stands at Rs 191.99.

Posted from WordPress for Android

NRB may relax spread rate provision, Bankers say

NRB may relax spread rate provision, Bankers say

KATHMANDU, JAN 31 – The Nepal Rastra Bank ( NRB ) has indicated that it may relax the provision that requires banks to maintain the rate at five percent within the current fiscal year, bankers have said.

After their meeting with NRB Governor Yuba Raj Khatiwada, Nepal Bankers’ Association (NBA) officials said the central bank may revise the existing method of calculating the spread rate.

NBA had sought a revision in the provision, stating that it would affect banks having a huge deposit base. The bankers were of the view that the current calculation method of directly reducing the interest rates on deposits and credit without calculating administrative costs created problems for many banks.

“Banks can invest just 80 percent of their total deposits,” said a banker who took part in the meeting. “The exclusion of operating cost from the calculation of spread rate has made life difficult for the banks.” He said Governor Khatiwada has assured of considering their concerns.

“Government-owned banks will be hit hard if the spread rate is calculated without administrative cost involved,” said a CEO of another bank. “The chances of a revision are high as state-owned banks will be severely hit if not done so.”

NRB Spokesperson Bhaskarmani Gnawali said it’s not that the current provision cannot be revised, but it has not been changed so far. He said the provision could be revised if such a measure would benefit both customers and the banks.

However, the compulsory provision has brought down spread rate of many banks. Out of 12 banks that made public their second quarter financial status, five of them have spread rate less than 5 percent. Nepal Bank, NMB Bank, Sanima Bank, Commerz and Trust Bank, Laxmi Bank, Century Bank and Siddhrtha Bank have brought down their spread rates to below 5 percent.

NRB had directed on October 10, 2013, to bring down their spread rates below 5 percent within the current fiscal year. But NBA on December 20 had urged the central bank to review the decision.

Spread Rates Compared:

Bank Spread rate (%)

Nepal Bank 3.59

BoK 6.05

Kist Bank 6.66

NMBBank 4.46

Citizens Bank 6.59

Global IME 5.96

Sanima 4.12

Commerz and Trust 3.99

Laxmi Bank 3.75

Century Commercial 4.93

Nepal Investment Bank 6.63

Siddhartha Bank 4.09

(Source: The Kathmandu Post)

Reliable, Shuva Laxmi and NCDB to merge at 112.70, 89 and 94 swap ratio

Reliable, Shuva Laxmi and NCDB to merge at 112.70, 89 and 94 swap ratio

ShareSansar, January 31:

Nepal Consumer Development Bank Limited (NCDB), Reliable Finance Limited and Shuva Laxmi Finance Limited are going to merge shortly.

NCDB and Reliable Finance have issued a public notice today to announce their special AGMs on February 17 to endorse the merger to form a national level development bank.

According to the notices, a merger committee of all the three BFIs has fixed the swap ratio for the merger at 112.70, 89 and 94 through an interest pooling method for Reliable, Shuva Laxmi and NCDB, respectively.

Following the merger, the merged company’s BoD would comprise of three representatives from Reliable, and one each from NCDB and Shuva Laxmi until the upcoming AGM of the merged company.