Uncategorized

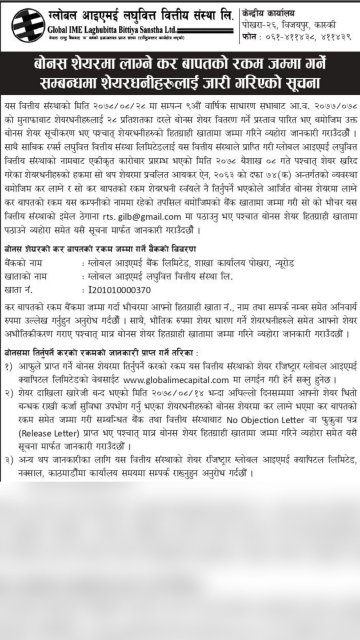

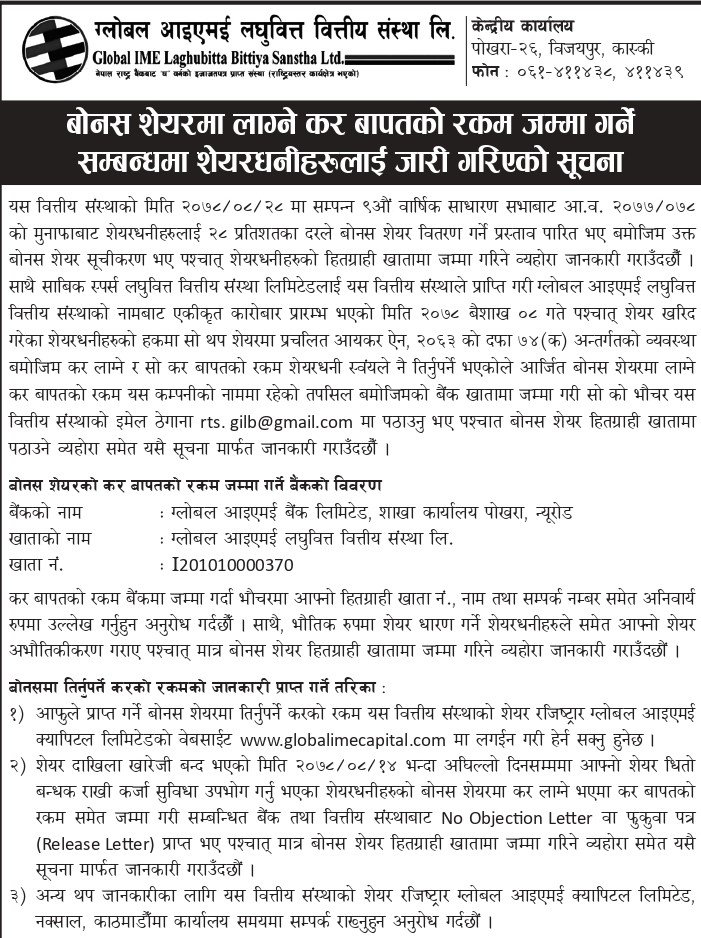

GILB Bonus Tax FY 2077/78

Please click the link below to check the bonus tax amount of FY 2077/78 and find the bank account details to transfer the tax amount: –

TAX LIABILITY LINK: https://www.globalimecapital.com/tax-liability-check

BANK ACCOUNT DETAILS:

Bank Name: Global Ime Bank

Bank Account Name: Global Ime Laghubitta Bittiya Sanstha Limited

Bank account no: I201010000370

C-ASBA Charge List (Updated 24-Feb-2022)

| Banks | Code | CASBA Charge |

| Agricultural Development Bank | ADBL | Rs. 10 |

| Bank of Kathmandu | BOKL | Rs. 10 |

| Nepal Bangladesh Bank | NBBL | Rs. 10 |

| Civil Bank | CBL | Rs. 10 |

| Machhapuchhre Bank | MBL | Rs. 10 |

| Sunrise Bank | SRBL | Rs. 10 |

| Siddhartha Bank | SBL | Rs. 10 |

| Prabhu Bank | PRVU | Rs. 10 |

| Nepal Investment Bank | NIBL | Rs. 20 |

| Himalayan Bank | HBL | Rs. 20 |

| NMB Bank | NMB | Rs. 20 |

| Citizen Bank International | CZBIL | Rs. 20 |

| Everest Bank | EBL | Rs. 20 |

| Kumari Bank | KBL | Rs. 20 |

| Sanima Bank | SANIMA | Rs. 20 |

| Laxmi Bank | LBL | Rs. 25 |

| Nepal Bank | NBL | Rs. 25 Renewal Fee |

| Prime Commercial Bank | PCBL | Rs. 10 |

| Nepal SBI Bank | SBI | Rs. 25 |

| Century Commercial Bank | CCBL | Rs. 25 |

| Standard Chartered Bank | SCB | Rs. 100 |

| Global IME Bank | GBIME | Rs. 15 |

Banks With Free CASBA Charge

| Banks | Code | CASBA Charge |

| Mega Bank | MEGA | Free |

| Nabil Bank | NABIL | Free |

| Nepal Credit Commercial Bank | NCCB | Free |

| NIC Asia Bank | NICA | Free |

| Rastriya Banijya Bank | RBB | Free |

CASBA Charge of Development Bank & Finance

| Banks | Code | Charge |

| Muktinath Bikas Bank | MNBBL | Rs. 10 |

| Mahalaxmi Bikas Bank | MLBL | Rs. 10 |

| Shangrila Dev. Bank | SADBL | Rs. 10 |

| ICFC Finance | ICFC | Rs. 25 |

| Garima Bikas Bank | GBBL | Free |

List for Nepse A grade companies (For sensitive index)

| Company Name | Sector | Code |

| Agriculture Development Bank | Bank | ADBL |

| Bank Of Kathmandu | Bank | BOKL |

| Century Commercial Bank | Bank | CCBL |

| Citizen Bank International | Bank | CZBIL |

| Civil Bank | Bank | CBL |

| Everest Bank | Bank | EBL |

| Global Ime Bank | Bank | GBIME |

| Himalayan Bank | Bank | HBL |

| Janata Bank Nepal | Bank | JBNL |

| Kumari Bank | Bank | KBL |

| Laxmi Bank | Bank | LBL |

| Machhapuchhre Bank | Bank | MBL |

| Mega Bank Nepal | Bank | MEGA |

| Nabil Bank | Bank | NABIL |

| Nepal Bangladesh Bank | Bank | NBB |

| Nepal Bank | Bank | NBL |

| Nepal Credit And Commercial Bank | Bank | NCCB |

| Nepal Investment Bank | Bank | NIB |

| Nepal Sbi Bank | Bank | SBI |

| NIC Asia Bank | Bank | NICA |

| NMB Bank | Bank | NMB |

| Prabhu Bank | Bank | PRVU |

| Prime Commercial Bank | Bank | PCBL |

| Sanima Bank | Bank | SANIMA |

| Siddhartha Bank | Bank | SBL |

| Standard Chartered Bank | Bank | SCB |

| Sunrise Bank | Bank | SRBL |

| Nepal Doorsanchar Company Ltd | Other | NTC |

| Citizen Investment Trust | Other | CIT |

| Arun Valley Hydropower Development | Hydro | AHPC |

| Butwal Power | Hydro | BPCL |

| Chilime Hydropower | Hydro | CHCL |

| Ngadi Group Power Ltd. | Hydro | NGPL |

| Ridi Hydropower Development | Hydro | RHPC |

| Soaltee Hotel Ltd. | Hotel | SHL |

| Oriental Hotel Ltd | Hotel | OHL |

| Asian Life Insurance | Life Insurance | ALICL |

| Gurans Life Insurance | Life Insurance | GLICL |

| Life Insurance Nepal | Life Insurance | LICN |

| National Life Insurance | Life Insurance | NLICL |

| Nepal Life Insurance | Life Insurance | NLIC |

| Prime Life Insurance | Life Insurance | PLIC |

| Surya Life Insurance | Life Insurance | SLICL |

| Everest Insurance | Non Life Ins | EIC |

| Himalayan General Insurance | Non Life Ins | HGI |

| Lumbini General Insurance | Non Life Ins | LGIL |

| Neco Insurance | Non Life Ins | NIL |

| Nlg Insurance | Non Life Ins | NLG |

| Prabhu Insurance | Non Life Ins | PRIN |

| Prudential Insurance | Non Life Ins | PICL |

| Sagarmatha Insurance | Non Life Ins | SIC |

| Shikhar Insurance | Non Life Ins | SICL |

| Siddhartha Insurance | Non Life Ins | SIL |

| Chhimek Laghubitta Bikas Bank | Microfinance | CBBL |

| First Micro Finance Development Bank | Microfinance | FMDBL |

| Global IME Laghubitta Bittiya Sanstha | Microfinance | GILB |

| Janautthan Samudayic Laghubitta Bikas Bank | Microfinance | JSLBB |

| Kisan Microfinance Bittiya Sanstha | Microfinance | KMFL |

| Laxmi Laghubitta Bittiya Sanstha | Microfinance | LLBS |

| Mahuli Samudayik Laghubitta Sanstha Ltd. | Microfinance | MSLB |

| Mero Microfinance Bittiya Sanstha Ltd. | Microfinance | MERO |

| Mirmire Microfinance Development Bank | Microfinance | MMFDB |

| Mithila Laghubitta Bikas Bank | Microfinance | MLBBL |

| Nagbeli Laghubitta Bikas Bank | Microfinance | NBBL |

| National Microfinance Bittiya Sanstha Ltd. | Microfinance | NMFBS |

| Naya Nepal Laghubitta Bikas Bank | Microfinance | NNLB |

| Nepal Grameen Bikas Bank Ltd. | Microfinance | NGBBL |

| Nerude Laghubita Bikas Bank | Microfinance | NLBBL |

| Nirdhan Utthan Bank | Microfinance | NUBL |

| NMB Microfinance | Microfinance | NMBMF |

| RSDC Laghubitta Bittiya Sanstha Ltd. | Microfinance | RSDC |

| Rural Microfinance Development Centre | Microfinance | RMDC |

| Samata Microfinance Laghubitta Bittiya Sanstha Ltd. | Microfinance | SMATA |

| Sana Kissan Bikas Bank Ltd. | Microfinance | SKBBL |

| Summit Micro Finance Development Bank | Microfinance | SMFDB |

| Suryodaya Laghubitta Bittiya Sanstha Ltd. | Microfinance | SLBS |

| Swabalamban Bikas Bank | Microfinance | SWBBL |

| Vijaya Laghubitta Bittiya Sanstha | Microfinance | VLBS |

| Womi Microfinance Bittiya Sanstha | Microfinance | WOMI |

| Central Finance Ltd | Finance | CFCL |

| Goodwill Finance Ltd | Finance | GFCL |

| Guheswori Merchant Banking and Finance Limited | Finance | GMFIL |

| Gurkhas Finance Ltd | Finance | GUFL |

| ICFC Finance Ltd | Finance | ICFC |

| Janaki Finance Ltd | Finance | JFL |

| Jebils Finance Litd | Finance | JEFL |

| Multipurpose Finance Company Ltd | Finance | MPFL |

| Pokhara Finance Ltd | Finance | PFL |

| Shree Investment and Finance Ltd | Finance | SIFC |

| Srijana Finance Ltd | Finance | SFFIL |

| Deva Bikas Bank | Development Bank | DBBL |

| Excel Development Bank | Development Bank | EDBL |

| Gandaki Bikas Bank | Development Bank | GDBL |

| Garima Bikas Bank | Development Bank | GBBL |

| Hamro Bikas Bank | Development Bank | HAMRO |

| Jyoti Bikas Bank | Development Bank | JBBL |

| Kailash Bikas Bank | Development Bank | KBBL |

| Kamana Sewa Bikas Bank Limited | Development Bank | KSBBL |

| Kanchan Development Bank | Development Bank | KADBL |

| Kankai Bikas Bank | Development Bank | KNBL |

| Mahalaxmi Bikas Bank Limited | Development Bank | MLBL |

| Mission Development Bank | Development Bank | MIDBL |

| Mount Makalu Development Bank | Development Bank | MMDBL |

| Muktinath Bikas Bank | Development Bank | MNBBL |

| Nepal Community Development Bank | Development Bank | NCDB |

| Om Development Bank | Development Bank | ODBL |

| Saptakoshi Development Bank | Development Bank | SKDBL |

| Shangrila Development Bank | Development Bank | SADBL |

| Shine Resunga Development Bank | Development Bank | SHINE |

| Sindhu Bikash Bank | Development Bank | SINDU |

| Tinau Development Bank | Development Bank | TNBL |

All about C-ASBA!

Introduction

ASBA means “Application Supported by Blocked Amount”.

- ASBA is an application containing an authorization to block theapplication money in the bank account, for subscribing to an issue.

- If an investor is applying through ASBA, his application money shall be debited from the bank account only if his/her application is selected for allotment after the basis of allotment is finalized, or the issue is withdrawn / failed.

- SEBON introduced the ASBA guideline and implemented fromMagh 1, 2073.

- According to new regulation from SEBON, ASBA will be mandatory for all the public issuance that will be issued after Shrwan 1, 2074.

C-ASBA

An Web Based Centralized Application developed by CDSC that complies with ASBA guideline which aims to provide the Online facility for different stake holders of complete Issuance process.

- Mero Share for Client

- C-ASBA for Issue Manager

- C-ASBA for Banks

- Mero Share for DP

Features of C-ASBA

- A Centralized Web application that will automate IPO issuance process providing the access to all the participants of the market.

- Provides a platform for banks and issue manager to process and verify the details of IPO/FPO applicant along with their mentioned BOID

- Provides a platform for investors to apply for IPO/FPO/Rights through the internet under ASBA guideline.

- Provides the system that will shorten the overall period of IPO processing( from 45+ days to 10- days)

- Facilitate to integrate the Demat Account of Investor with their Bank Account so that the payment system of the share transaction can be automated in future.

Participant

- CDSC

Develops a Centralized System and Provides a platform to connect all of the participants during securities issuance.

- BANK

Verifies Bank Account Information of the Investors with Demat

Account Information

- Takes a standing instruction from the client which states that ” The client agrees that the bank can debit/freeze the amount from/in his BANK Account if the instruction is initiated for the mentioned BOID(Which is verified by BANK).

- Blocks the Funds in the Investors Bank Account according to the information received from the System

- Debits the Funds as per the information received from the System

- Releases the blocked amount as per the information received from the system

- Issue Manager

- Provides the Issue details to CDSC

- Downloads the detail Report of IPO Application

- Checks and Verifies for the Duplicate Applications

- Finalize the Valid Applications and Process for the Allotment

- Conclude the Allotment

- Upload the Allotment Detail in the system

- Verifies the allotted Amount Debit Confirmation report form Bank

- Verifies the non allotted Amount report from Bank

- Investor

- Provides the bank Account information to be updated in their Demat Account

- Fill-up the Declaration Form which states that he allows to Block/Debit his Bank Account as per the Instruction from CDSC/Mero Share

- Provides the Demat Account Detail along with Bank Account Details to his Bank

- Subscribe for Mero Share Application

- Applies for IPO from the Mero Share application.

- DP

- Updates the Bank Account Information of BOs to CDAS application

- Provides the Login Information for Mero Share Application to BO

Process

- Bank Account Information Update in CDAS Application

- Investor will provide bank account details to their respective DPs

- DP will update bank account details of the respective BOID holder in CDAS application.

- Client Registration by Bank

- CDSC will provide C-ASBA Application login to Banks .

- The Bank will Prepare a C-ASBA Registration Form(CRF) which states that the Investor agrees to let the bank to debit or freeze his Bank account if such request was initiated with mentioning the UNIQUE CODE called C-ASBA Registration Number(CRN) that was provided by the bank during Registration.

- Investor will fill up CRN with his Demat Account details and Bank Account details.

- Bank will check and verify the Demat Account details that is available in C-ASBA application along with the Bank Account details available in Banking System and the details mentioned in the CRF.

- Once the details is verified, the Bank will register the Client in C-ASBA Client

- Registration module and provides CRN to the client.

- The Client Registration will make the client eligible to apply for the Issue under ASBA guideline.

- Issue open for IPO

- Issue Manager will provide Issue details for IPO application to CDSC.

- CDSC will add Issue details to C-ASBA application.

- C-ASBA application will reveal the issuance details for the concerned users.

- Apply for IPO using Online application

- Investor will get Mero Share login from his own DP.

- Investor will submit CRF to his bank and receive CRN.

- Investor will get a application portal (MY ASBA) activated in his Mero Share application once the bank registers the client to C-ASBA and provides the CRN .

- Investor will apply for the IPO through ASBA portal using his CRN.

- Bank will get the application report to his C-ASBA application.

- Bank will download the freeze instruction file for all the received application and upload to their CBS system.

- Bank will generate and upload Confirmation Report to the system.

- Issue Manager will generate the report and process for the allotment.

- Apply for IPO using Physical application

- Bank will provide a Application form for IPO application to their client. (The Form must have one extra field to fill up the CRN number.)

- Investor will Submit the Application form mentioning their CRN number to his bank

- Bank will enter the BOID of the applicant in C-ASBA application and fill up the applied quantity mentioned in the application form.

- Bank will check the CRN number mentioned in the application form at the time of application submission in the system.

- Bank will generate the Application Report at the end of the day.

- Bank will Block the amount as per the report generated by the system and upload the response file .

- Issue Manager will generate the report and process for the allotment.

- Issue Manager will upload the allotment report in the system

- Bank will download the Allotment report from the system and Debit/Unfieeze the Amount from the applicant Account.

Source: C-ASBA Manual prepared by Mr. Suresh Neupane, Sr. IT Officer, CDSC.

Brief Introduction and features of CDS and DEMAT A/C

What is CDS?

CDS stands for Central Depository System.

What is CDSC?

CDSC stands for CDS and Clearing Limited. It is a company established under the company act and is promoted by Nepal Stock Exchange Limited (NEPSE) in 2010 to provide centralized depository, clearing and settlement services in Nepal.

What is DEMAT A/C?

DEMAT stands for dematerializaion in short. Demat A/C is the type of account where we deposit shares, just similar to bank account. DEMAT A/C is compulsory for trading. If you are a trader and you buy/sell shares often, this is a must.

What are the benefits of creating DEMAT A/C?

- Dematerialization of shares. i.e. shares are converted into electronic form from physical form. No need to worry about loss and tearing of share certificates.

- No need of Name Transfer. i.e. there will be no such thing as BT as the shares will come to your name within some days of purchase.

- You can sell part of your shares without needing to split the shares before selling.

- Bonus shares are transferred into your DEMAT A/C. i.e. no need to wait in line to receive your certificates and wait for listing of bonus shares.

- Applying for IPO and receiving alloted shares on your DEMAT A/C.

Where can I create DEMAT A/C?

One can create DEMAT A/C from any of the listed Companies:-

- Civil Capital Market Ltd.

- ACE Capital Ltd.

- Stock Management & DP Ltd.

- Nabil Investment Banking Ltd.

- NIBL Capital Markets Ltd.

- Laxmi Capital Ltd.

- Everest Bank Limited

- Siddhartha Capital Limited

- NMB Capital Limited

- Bank of Kathmandu Limited

- Global IME Capital Limited

- Dipshikha Dhitopatra Karobar Co. Pvt. Ltd.

- Trishakti Securities Public Ltd.

What are the charges for creating and maintaining DEMAT A/C?

- Account opening charge:- Rs. 50

- Operating Charge:- Rs. 100

- Yearly Renewal Charge:- Rs. 100

How can I dematerialize my shares?

One can dematerialize the shares by filling demat request form on the concerned DP and providing share certificates to them.

Can I create and use DEMAT A/C of my family members?

Yes, you can dematerialize the shares owned by your family members. For this, you will have to fill up another type of form which is designed for using other’s account by gaining authority from them. You can do so from the same DP.

Century commercial Bank’s share allotment result: 7.95% for upto 50 thousand and 3.09% to more; upto 12 thousand under lottery

March 4th: Century Commercial Bank allotted 7.95% for the applicants applying less than and equal to 50 thousand rupees and 3.09% for those applying more than 50000 rupees in it’s IPO issued worth 920 million.

The IPO was over subscribed by around 22.5 times and collected 20 arba rupees.

The allotment result can be viewed from the given link.

http://www.sharesansar.com/listnewscategory.php?catid=14&id=